What amount of currency must be declared. How much currency can you take out of Russia in cash? What does not need to be declared

| Question | Answer |

| · Spain – no more than $10,000; · Israel – up to $29,000 or €21,000; · China – no more than $5000; · Thailand – up to $20,000; · Finland – $10,000; · Germany – $10,000; · Georgia – 25,000 GEL or 2,000 $. |

|

| 10,000 US dollars. | |

| At the exchange rate of another country. The calculation is based on the current exchange rate of the country into which the person is entering. | |

| · Russian rubles; · banknotes; · foreign currency; · coins in circulation, except those made of precious metal; · travel bills; · securities in the form of documents. |

|

| The violator faces administrative liability or a fine. The size of the fine depends on the size of the hidden amount of money. Restriction of freedom for up to 4 years or correctional labor is possible. |

|

| · Full name, date and place of birth, residential address; · participants of the Customs Union must indicate the place of registration; · for non-participants – point of stay (hotel, relatives’ address); · present a visa or passport; · indicate the amount imported across the border; · information about monetary instruments with the date, name of the organization that issued them, if an identification number is assigned; · information about the origin of funds (certificate of income, notice of sale of real estate); information about the intended use of money; · information about the person who imports funds, if they are not subject to; · travel route. |

|

| No, the amount of money on the card has no limit. |

Is it possible to have dual citizenship Russia Kazakhstan - why not but possible?

In 2019, no innovations are envisaged regarding the import and export of currency across the Russian border. But it should be remembered that in accordance with paragraph one of Article 200.1 of the Criminal Code of the Russian Federation, the fine for currency smuggling ranges from 3 to 10 times the amount of the undeclared amount.

When traveling from Kyrgyzstan to Russia or from Kazakhstan to Armenia through the Russian Federation, there will be no restrictions on the import of currency, since, from the point of view of the customs authorities, this is considered movement through a single customs zone.

When crossing the border in the customs zone of the Russian Federation, in accordance with Law No. 90-FZ, it is required to declare in writing the import of cash into the country if its amount exceeds the established limit of 10 thousand US dollars.

What means are taken into account

When passing control at customs, the following are taken into account:

- cash foreign currency;

- banknotes, treasury notes;

- Russian rubles;

- coins in circulation, except those made of precious metals;

- traveler's, bank checks, bills of exchange;

- external and internal securities in the form of documents confirming payment of debt obligations if the individual data of the person to whom they are intended is not indicated.

Termination of Russian citizenship only after payment of all taxes?

The total amount of money in the equivalent of up to 10,000 US dollars is not subject to declaration.

Ordinary people can transport these valuables without quantitative restrictions.

The control procedure itself allows you to maintain statistics and track the movement of large amounts of cash, as well as securities.

Import standards

For individuals, there are requirements for importing currency into Russia at a time in a total amount equal to or not more than $10,000. There is no need to declare cash or traveler's checks. When the amount available to a foreigner exceeds the specified limit, it is mandatory to fill out a declaration.

A citizen has the right to register imported funds upon entry, not exceeding 10 thousand, at his own request.

Those planning to cross the border or go on vacation abroad are concerned about the amount of money that can be imported into other countries without declaration. For example, when entering the European Union, you are allowed to freely import amounts in the equivalent of up to 10,000 euros. You can freely export to other countries:

- Thailand – up to $20,000.

- China – up to $5,000.

- Israel – $29 thousand or 21 thousand €.

- Spain – up to $10,000.

- Finland – up to $10,000.

- Germany - 10,000 €.

- Czech Republic – 10,000 €.

- Georgia – up to 25,000 lari or $2,000.

- Kazakhstan – up to $10,000.

- Ukraine – up to 10,000 €.

How can an employer employ a foreigner in the Russian Federation?

What does not need to be declared

There is no need to declare the import of funds if the amount per person, including a child, is equal to or less than 10 thousand US dollars. For example, if a family of 3 people arrives - two adults and one minor, the customs officer has the right to allow an amount of 30 thousand US dollars to pass without declaration.

Citizens who import money in another currency, in an amount close to 10 thousand dollars, should inquire in advance about its exchange rate in effect at the time of entry, so as not to exceed the limit.

Those who do not import currency or goods that require clearance can pass through the customs zone along the so-called green corridor.

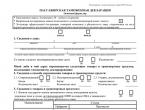

Filling out the declaration

The passenger customs declaration has a standard form that must be filled out at the airport before boarding the plane, or at the station, by hand in block letters. It states:

- Full name, place and date of birth, home address;

- residents of the Customs Union (Belarus, Kazakhstan, Kyrgyzstan, Armenia) need to indicate their place of residence (registration);

- for non-residents of the Customs Union - the point where the foreigner is temporarily staying (hotel, address of friends, relatives, acquaintances, etc.);

- present a document on the basis of which entry is carried out (visa, foreign passport, etc.);

- the amount imported into Russia;

- data on monetary instruments (except for traveler's checks) with the date, name of the organization that issued them, if an identification number is assigned;

- information about the origin of imported/exported funds - a certificate of income received, confirmation of the sale of property, notarized deeds of gift, inheritance documents, etc.;

- information about the intended use of money;

- information about the owner of the imported finances, if they do not belong to the declarant;

- delivery option and route (mode of transport).

How can a foreign citizen confirm a temporary residence permit in Russia - how to avoid deportation?

Fees

There is no duty charged when moving money across borders. Cash in various currencies equivalent to $10,000 is imported duty-free. If there is more, you need to obtain the appropriate permission from the bank for export.

Fine for smuggling

Declaring money at customs that exceeds the established limit, which does not need to be formalized, is a mandatory rule for legitimately crossing the country’s border, along with other conditions in force in the Russian Federation.

Illegal movement through customs of funds that are not declared in the declaration and exceed those established by the rules of transportation entails administrative liability or a fine to the person carrying out this illegal action. Its size depends on aggravating circumstances (volume, number of persons involved), and exceeds the amount hidden from customs authorities by 3–15 times.

It is also possible to restrict freedom for up to 4 years or perform forced labor for a similar period.

A particularly large amount is considered to be an amount that is 2 times larger than what is allowed for transportation by customs rules. Finances identified during inspection may be confiscated by court decision.

Until 2010, there was a law in the Russian Federation according to which it was possible to export up to $3,000 abroad without a declaration. To export amounts of more than $3,000, the money had to be declared. If a citizen crossing the border had more than $10,000, then permission from the Central Bank was required. In 2010, Russia joined the Customs Union, which entailed changes in the rules for the import and export of funds.

A customs union is an agreement between two or more countries to abolish customs duties and create a single customs territory. The member states of the Customs Union are Russia, Kazakhstan, Belarus and Armenia.

Rules for exporting currency, when there is no need to declare funds, how much can be exported without declaration and what liability awaits for violating the rules - all these issues are regulated by the Customs Code.

In what form can you take money out?

Currency is represented in both cash and non-cash means. Cash is all coins and banknotes, except for coins made of precious metals, available to a citizen. It is these funds that customs officers are interested in when crossing the border.

Cash held on debit cards, as well as credit cards, will not attract interest from customs officers. However, it is not profitable for Russians to use cards abroad due to the high interest rates charged for cash withdrawals.

In addition to cash and funds on cards, it is allowed to export abroad:

- bills of exchange (monetary documents obliging the payment of funds);

- securities (documents establishing property and non-property rights);

- traveler's checks (a monetary obligation to pay a certain amount of money to the owner of the document);

- settlement checks (a document giving the right to receive the amount of money indicated in the check).

How much money can you carry across the border?

The export of currency from Russia abroad is regulated by Federal Law No. 173 “On Currency Regulation and Currency Control.” It states that the export of currency abroad is carried out without restrictions. The Russian Federation joined the Customs Union and signed the corresponding agreement, which regulates the movement of currency through customs and determines the amount of funds allowed for export without declaration and payment of duty.

How much money can you take out without declaration?

Any citizen can transport abroad an amount of money equal to $10,000. To transport this amount, a declaration is filled out at the request of the owner of the funds. All cash in any currency held by a citizen is converted into dollar equivalent at the current exchange rate.

It is worth noting that this restriction applies to one citizen, and not to the family as a whole. If a family of 4 people goes on a trip, they have the opportunity to take out up to 40 thousand dollars. When calculating the norm, each family member, including the child, is taken into account.

The export of traveler's checks is also limited. The amount of checks taken abroad is added to the cash.

How much money can you carry on a plane?

If a citizen travels by plane, the general rules for transporting funds apply. The same limit has been established for the export of cash – $10 thousand. If a tourist has a smaller amount, he has the right to go through customs control at the airport through the “Green Corridor”. Passing through customs in this way means that the person does not have items and monetary instruments that need to be declared, and takes less time.

If the money is more than $10,000

The rule limiting the amount of exported funds does not apply to persons who declared money upon entering the territory of Russia. Thus, the citizen is allowed export not only $10,000, but also all funds declared at customs upon entry. To do this, you will need documents issued by customs officers and present them at control.

If, when importing funds, all the rules regarding the declaration and the permitted amount of money were observed, and when exporting the amount of funds turned out to be more than the permitted norm, there is a way not to violate customs legislation. To do this, you should leave part of the money for safekeeping at the customs office. At the same time, free storage of finances is allowed for 2 months.

Another way is to collect funds on a bank card. Any amount on the cards is not subject to mandatory declaration.

It is better to familiarize yourself with the rules for importing funds into the country where the citizen or family is going. For example, when entering Bulgaria you are allowed to carry up to $1,000. In addition, it is worth remembering that when moving through the country in transit, standard customs rules do not apply. There are also other procedures when crossing the borders of member states of the EAEU Customs Union.

What else you need to know when exporting and importing money

- The funds declared when exported from Russia do not have to be imported in the same currency.

- Citizens visiting a foreign country in transit are exempt from filling out a declaration due to the fact that they do not need to undergo customs control.

- The rules for transporting currency apply to both Russian citizens and foreigners.

- The procedure for exporting and importing money is the same for all countries except the countries participating in the Customs Union.

How to declare money at the airport

When importing or exporting an amount of money exceeding the limit of 10 thousand dollars, all funds and monetary instruments available to the citizen must be declared.

When filling out the declaration, you should consider some nuances:

- money is not only the Russian ruble, but also all types of currencies. In this situation, traveler's checks are equivalent to money. Money and traveler's checks are added up;

- bank checks, bills and shares are combined under the concept of “monetary instrument” and are subject to mandatory inclusion in the declaration, even if their amount is less than 10 thousand dollars;

- when drawing up a declaration, all funds and instruments are indicated, and not just those that went beyond the permitted limits;

- filling out the declaration implies passing customs control through the “Red Corridor”;

- Any citizen has the right to fill out a declaration at his own request, even if he has a smaller amount of money.

In the customs declaration form issued when passing through customs, you must indicate the following information:

- personal data (full name, place and date of birth, passport details);

- source of income (salary, dividends, pension and other payments, loan funds, profit from the sale of property);

- how the exported funds will be spent;

- how the funds will be transported;

- itinerary.

When filling out the item on the source of income, you will need to present documents establishing the legality of receiving the money (certificate of income, deed of gift, will and other papers). It is not always possible to obtain such a document. This is the main reason why citizens are wary and reluctant to fill out a customs declaration.

Attention! When transporting monetary instruments, it is mandatory to indicate information about them - document number, date of issue and name of the organization that issued the security.

What are the consequences of violating the rules when transporting funds?

Persons who violate the rules for transporting money and try to transport a large amount without a declaration will be held accountable. The sanction for violation of customs legislation depends on how the unlawful action is characterized:

- administrative violation;

- smuggling.

If a citizen fails to declare or provides false information about funds and instruments when crossing the border, his action will be defined as an administrative offense. In this case, the violator faces a fine (fixed or in the form of a percentage of the amount transported illegally) or seizure (confiscation) of monetary instruments.

At the same time, it is allowed to export cash in rubles or foreign currency from the territory of the Russian Federation, the amount of which should not exceed 10 thousand USD in cash equivalent.

Updated rules for exporting foreign and local currency from Russia

Until 2010, the Russian Federation had a law according to which it was allowed to export up to 3 thousand dollars from its territory without filing a declaration and 3-10 thousand dollars with a declaration. If the amount of cash being exported was more than 10 thousand dollars, its export could only occur with official permission from the Central Bank of Russia. And in 2010, the rules for exporting cash were significantly simplified.

Carrying cash without filing a declaration

When crossing the Russian border without any significant restrictions and without filing a customs declaration, you can carry the above amount.

You should pay attention to the following points: 10 thousand dollars can be expressed in the sum of all currencies that the person carrying cash with him has with him. This amount is calculated not only for one adult person, but also for children.

For example, a married couple with a child can bring up to 30 thousand dollars across the border without filing a declaration for the export of cash.

Money on plastic cards is not included in this amount. The passenger's plastic cards are not subject to customs declaration.

Money in the form of traveler's checks is considered cash and must therefore be added to cash.

It is best to exercise caution for all passengers and tourists who carry with them an amount of money in various currencies, the rate of which, when converted to US dollars, is close to an amount equal to 10 thousand. In this case, before going to the airport or train station, it is better to check the data on the latest exchange rate of the Central Bank of Russia.

It is best to combine Russian rules for exporting currency with the rules for importing cash into the country.

Thus, you can safely take out cash in the amount of up to 10 thousand dollars from Russia without filling out a declaration, and bring only one thousand dollars into Bulgaria without a customs declaration.

If a tourist takes out from Russia an amount of cash not exceeding 10 thousand USD, and goods that are subject to declaration, then he can easily cross the border and customs control.

Let's start by making sure we understand the term “currency” correctly.

The definition of “currency” is understood as a monetary unit used in the territory of a certain state for settlement transactions. Such a monetary unit can be represented in banknotes of various forms:

- metal coins, paper notes, including those that must be retired from circulation but can still be converted;

- funds in electronic form, namely funds in bank accounts.

Currency can be convertible and non-convertible, foreign and national, as well as international, for example, EURO. In the context of this article, along with currency, a payment document such as a traveler's check will be considered, despite the fact that the prospects for its use in the future are decreasing, since it is being successfully replaced by a payment card. A traveler's check with a number and series can be purchased at a bank; it can be exchanged for EURO or US dollars without paying a commission.

Governing legislation

In this article we will look at the features of exporting currency from the customs territory of the Russian Federation. State control is carried out with the aim of regulating the movement of currency between states, as well as, among other things, tracking the sources and amounts of income of Russian citizens in order to prevent tax evasion. Due to the complexity of the task posed to the legislative framework in this area, the legislative acts valid today are reviewed, finalized, and amended and supplemented from time to time.

Violation of established norms leads to liability of the violator, which arises in accordance with Russian legislation.

The export of currency from Russia is regulated by the Federal Law “On Currency Regulation and Currency Control,” the text of which can be found in detail on the website, and by regulations of currency management authorities. The law defines the terms and conditions for the export of cash that is or is not subject to declaration. Currency control in the Russian Federation excludes unjustified interference of state policy into the private lives of residents and non-residents. Protecting them from unlawful actions on the part of regulatory authorities. In any case, if a violation of the law has occurred or, from the point of view of the accused, the charges are unfounded, the decisions of the currency control agents can and should be challenged in the manner prescribed by the law of the Russian Federation.

According to the legislation, there is a unified procedure according to which individuals (residents and non-residents) can export cash foreign and national currency from Russia. Restrictions on the exported amount refer to the total amount of foreign and/or national currency that an individual intends to export from Russia. Limits are indicated in US dollars, so all exported currency must be converted into dollars at the rate of the National Bank of the Russian Federation on the date when customs clearance is performed. According to the law, residents and non-residents must freely provide the authorized bodies at customs with documents and information necessary to carry out currency control.

Amounts of currency (foreign and national) allowed for export from Russia

In connection with the above, it becomes obvious that incompetence in legal aspects that relate to border crossing by a resident or non-resident, and violation of laws regarding the export of currency from the Russian Federation may lead to at least administrative liability.

Restrictions for one-time export of currency:

- One resident or non-resident is allowed to export foreign currency from Russia in cash not exceeding an amount equivalent to 10,000 US dollars.

- If upon entering the customs territory of Russia a certain amount of currency was imported and declared, then when leaving Russia you can take out the amount that was declared in the customs declaration upon entry.

- If national currency is exported, the total amount should not exceed the equivalent of 10,000 US dollars, with the exception of the amount declared upon entry.

- There is an age restriction due to the fact that minors under the age of 16 are not allowed to fill out a customs declaration on their own. Therefore, if children under 16 years of age travel abroad unaccompanied by adults, they can export cash currency in an amount not exceeding the equivalent of 3,000 US dollars.

Declaration when leaving the Russian Federation and exporting funds.

Every resident or non-resident traveling abroad undergoes customs control, which is carried out by customs officials. The procedure includes checking documents, performing an oral interview, and allowing personal inspection. A customs declaration is filled out in form TD-6 in accordance with the Order of the Federal Customs Service of the Russian Federation dated November 30, 2007 No. 1485 "On approval of the passenger customs declaration form and the procedure for filling it out."

There are two ways to declare, which have equal significance: written and oral. When declaring orally, the amount of the amount must be indicated as accurately as if it were written down in the document. If an individual does not declare in writing or orally the presence of a currency required to be displayed in the declaration, then it is assumed that he does not have such currency. Russian customs points are equipped with systems of “green” and “red” channels for simplified customs control. Travelers who do not have goods that are subject to mandatory declaration in writing pass through the “green” channel. This is equivalent to an oral statement to the customs officer that there is nothing to declare. The “Red Channel” is intended for those traveling with goods that must be declared. The declaration must be completed in two copies and should not be amended. If it is necessary to make changes to an already completed declaration, it is necessary to certify such correction with the signature of the person submitting the declaration and the seal of the customs authority that accepts this document. One copy is intended for an official, the second for an individual and must be kept by him until his return, so that when passing through customs control it is possible to document, for example, the imported declared amount of currency.

Foreign currency is declared

Without declaration and without issuing a special document, those leaving have the right to take with them the amount of money not exceeding $3,000, or equivalent. If a large amount is exported, then the entire amount (not only the excess) must be indicated in the declaration. In this case, the customs officer has the right to inspect the traveler, regardless of whether the declaration is completed or not. If an amount is discovered that exceeds the permitted non-declared limit of $3,000, then a violation of the law is officially recorded.

National currency is declared

The above requirements for filling out the declaration also apply to the national currency, i.e. an amount exceeding the equivalent of $3,000 must be indicated in the declaration of a person traveling outside the Russian Federation.

Traveler's checks are declared.

Traveler's checks are exported without restrictions, and when declared, they are added to the currency and if the received amount exceeds $10,000, then it is subject to mandatory declaration.

Bank cards

Bank cards are not subject to declaration.

Special documents may be required to export an amount that exceeds the amount allowed for export without declaration:

- an official certificate from the bank, duly executed (a check issued by an ATM is not valid);

- permission from the Central Bank of the Russian Federation for export if the amount exceeds 10,000 US dollars.

It should be noted that the inspection of residents and non-residents leaving the Russian Federation by customs officials is selective. But if undeclared currency or an amount exceeding established limits is discovered, sanctions will be applied for violating the law.

Sanctions for illegal export of currency

If the requirements for the export and declaration of currency are not met, then the departing an individual bears administrative responsibility, taxable a fine of 1,000 to 2,500 rubles. The amount exceeding the legally established limits of amounts allowed for export or not required for declaration is not confiscated, but can be returned to the mourner or transferred to storage organized at the customs point. Such storage services are provided for a period of 2 months (with a possible extension for an additional 4 months). In this case, the customs officer must issue a receipt in the TS-21 form and give it to the departing person. This receipt is required to receive valuables deposited for safekeeping.

Subsequently, the case of violation of currency legislation by customs officers is transferred to the Federal Service for Financial and Budgetary Control, which, after considering it, makes an appropriate decision.

If the identified violation is represented by a particularly large amount (exceeds 250,000 rubles), then the export of such an amount is considered as smuggling, which is regulated The Criminal Code provides for a fine or imprisonment for up to 5 years.

Everyone is aware that it is forbidden to take sharp or cutting objects on a plane, but the security service may also find the impressive amount of money a passenger is carrying suspicious. If the amount of cash exceeds the legal limits, it will be confiscated. Let's find out how much money you can carry on a plane in 2019.

Carrying money on an airplane

Most countries have rules for the transportation of money, both export and import. The exception is China, where there is no control.

Russia is subject to the acts of the Customs Union of the Eurasian Economic Union. It includes Belarus, Armenia, Kazakhstan, the Kyrgyz Republic and Russia. The import and export of capital by individuals on the territory of the Union is regulated by:

According to the EAEU Labor Code, there are almost no restrictions on transportation within the state, and when exporting capital there is a limit, if exceeded, it is necessary to fill out a Declaration in the red corridor.

Domestic flights

The transportation of money on an airplane within Russia is not limited. You are allowed to take cash into the cabin with hand luggage. There is also a weight limit. A suitcase or bag should not exceed 10 kg, which is explained by the rules for carrying hand luggage in airlines, and not by the regulation of funds. Therefore, experienced travelers advise taking money in large bills to reduce the weight of luggage.

Important! No one is responsible for the safety of funds during the flight.

International flights

How much money can you take with you abroad? Many countries have their own rules for the import and export of currency. The average figure above which funds must be declared is 10 thousand dollars. For Russia, exports are limited to precisely this figure.

Let's take a closer look at examples of countries:

Currency also includes traveler's checks.

Reference: this is a security with an indication of the denomination and places for 2 signatures of the applicant (the first is placed when purchasing the security, and the second when exchanging for cash). Checks are issued in denominations of 20$, 50$, 100$, 500$ and 1000$ and 50 EUR, 100 EUR and 500 EUR. Russian banks work with American Express and Thomas Cook traveler's checks.

Plastic cards can contain money of any amount; electronic invoices are not considered by the customs service.

For the unauthorized import of currency that exceeds the permissible norms in different countries, different punishments are provided. Thus, in Germany, undeclared cash is subject to a fine of 1,000,000 EUR. In Algeria, the smuggler will receive a criminal sentence.

Currency or rubles

When traveling to another country, you can take cash in any currency. If a passenger is transporting rubles, euros and dollars, then all money is transferred according to today's dollar exchange rate of the Central Bank and added up to a total amount that should not exceed 10 thousand dollars.

If you are transporting an amount bordering on the limit, it is better to convert it into dollars on the day of the flight to protect yourself from unexpected rate fluctuations.

Note! The amount of $10,000 is the limit for each person separately. If you're a family of four, the total for everyone would be $40,000.

At the same time, arrange the money so that everyone in their bag does not exceed the limit. You are allowed to put cash even in children's carry-on luggage.

Declaration of money and customs declaration form

An inventory of transported bills of exchange, securities and bank checks is added to the cash declaration.

For the procedure, the passenger fills out 2 copies of the document. The applicant keeps one form for himself and presents the second in the red corridor. The declaration form can be downloaded yourself using our website or using the official website of the Federal Customs Service, printed and filled out in advance.

Download for viewing and printing:

Note! If you want to print the declaration in advance, please note that the form must be printed on the front and back of an A4 sheet. Remember! Even if you have completed the declaration at home, you must go through the red corridor. Otherwise, it will be considered an illegal transfer of funds.

If you know in advance that you will need to record the transportation of cash, you need to arrive at the airport 20-30 minutes earlier than planned.

What does the procedure include:

- Passing customs inspection;

- Receiving forms and their subsequent filling out;

- Visit to the red corridor in the airport area.

If a declaration is required for a child under 18, it must be completed by a parent, guardian or legal representative. It is necessary to provide documents confirming relationship or power of attorney.

The declaration contains the following information:

- Passport data;

- Registration address;

- Country of destination;

- Number of children if traveling with parents;

- Amount of cash;

- List of things subject to declaration;

- Date of completion;

- Applicant's signature.

Consequences of unauthorized transportation of money

If violations are detected, customs officers apply penalties. Depending on how much the amount exceeds the norm, the punishment varies.

Punitive measures may be limited to a warning or a fine from one thousand to 2,500 rubles.

If the amount exceeds $10 thousand several times, the violator may face criminal liability.

In case of such a serious excess, the level of liability is regulated by the Criminal Code. Payment of the transported amount multiplied by 3-5 times is provided. Sometimes it can reach tenfold values.

An alternative preventive measure is payment of funds 3-10 times more than the salary received or other source of income.

If the violator transported an amount 5-10 times the limit, employees have the right to withdraw wages for 3 years or demand payment of an amount 10-15 times the amount transported.

Can they take the money?

The law allows customs officers to seize funds in excess of the established norms for transportation abroad.

If the excess is small, authorized persons leave $10,000 to the owner and confiscate the rest.

A large excess requires a different procedure:

- Confiscation of funds;

- Drawing up a protocol of violation in two copies. The second is awarded to the offender;

- Transfer of the case to the judicial authorities.

After which the court decides whether to issue a fine or complete confiscation. The department is conducting an investigation. If it is determined that the violator has obtained funds through illegal means, they will be completely confiscated.

Note! The fine is paid in rubles.

When issuing a fine, the amount payable is recalculated at the exchange rate on the day the protocol is signed.

There are situations when a passenger has the right to appeal the decision of the customs authorities to withdraw the amount. For example, if a person has not yet crossed the territory of the green corridor, but his funds have already been confiscated.

Video about how much money you can transfer abroad.