Reason codes for writing off low value items. Reasons for writing off MBP examples terms RB MB 8 reason for writing off

The formation of an act for writing off low-value and wear-and-tear items occurs when the property classified as such items becomes unusable for some reason. As a rule, the unified form MB-8 is used for this.

FILES

What applies to low-value and high-wear items?

In all organizations, one way or another, there is inexpensive and not particularly valuable property that is used in current work. It is not reflected as and its cost is quite small. This includes:

- computer and office equipment;

- Consumables;

- pieces of furniture;

- workwear;

- dishes;

- cleaning and detergents, etc.

This group also includes some tools, equipment, inventory, spare parts, in general, everything that is used to solve various problems in production, but quickly wears out and requires constant replacement.

In order to determine that an item is truly of low value and wears out quickly, you need to make sure that its shelf life does not exceed one year, and its cost does not exceed 40 thousand rubles.

The meaning of the write-off act

All property that the organization has must be recorded in special documentation. The fact of its presence has a direct impact on taxation (although only when using certain schemes, for example, the general tax system).

At the same time, in order to get rid of the property registered to the enterprise, it is necessary to draw up a special act - such a document allows you to write off unnecessary, obsolete, worn-out materials, equipment, etc. in a legal way.

For each type of inventory, there are different forms of documents; there is a special form for writing off low-value and wear-and-tear items.

Creation of a commission

Any property of an enterprise is written off, as a rule, by a specially created commission. It may include both company employees and third-party experts.

The appointment of commission members occurs by drawing up an appropriate order, which also approves the need to write off low-value items and which is issued on behalf of the director of the organization.

Members of the commission perform the following actions:

- study technical documentation (if any),

- certify the fact that the property has fallen into disrepair, is outdated or worn out,

- looking for reasons for this

- record that repair and further use of these inventory items is impossible.

Features of drawing up an act, sample

Today, there is no mandatory, unified form of an act for writing off low-value and wear-and-tear items, so employees of enterprises have every right to write an act in any form or, if the organization has a developed and approved sample document, according to its template. In addition, very often company representatives prefer to use the previously generally used form MB-8. This is due to the fact that it is clear and convenient in structure, contains all the necessary information, and there is no need to rack your brains over the composition of the document.

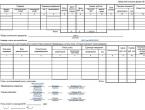

Filling out the header of the MB-8 form

The “header” of the form contains several lines for approval by its director - without his autograph the act will not acquire legal force. Then it is indicated:

- number assigned to the act;

- name of the organization and structural unit in which the write-off occurs, its OKPO code.

Filling out the front page of form MB-8

Under the “header” of the document there is the first table, where the following is entered:

- date of drawing up the act;

- transaction type code (in accordance with the classifier);

- structural unit that writes off inventory items;

- type of company activity (according to OKVED);

- information about the subaccount and analytical accounting code.

Below you enter the date of formation of the commission, the order number and the fact of write-off is recorded.

The second table includes detailed information about the property being written off:

- its name,

- quantity,

- cost,

- date of receipt,

- service life,

- reason for write-off and other characteristics.

Filling out the back page of form MB-8

On the reverse side of the act, there is first a continuation of the previous table, at the bottom of which the totals for the items being written off are summarized. Below it is indicated the total number of items, numbers and dates of their disposal. The last table of the act includes information about disposal.

What to pay attention to when registering

The execution of the act is completely left to the compiler. Form MB-8 can be filled out in handwriting or on a computer, while when printing it, you can use the organization’s letterhead or an ordinary sheet of paper.

The only condition that must be met: the act must be signed by all responsible persons included in the commission (autographs of employees involved in writing off low-value and wear-out items must be “live”).

But it is necessary to certify the form using a seal or stamp only if the norm for the use of stamp products is enshrined in the internal regulatory documents of the organization.

The act is drawn up in one copy, but if necessary, you can make additional copies of it.

What to do after drawing up the act

After drawing up the act, the written-off low-value and high-wear items are sent to scrap (to the closet or warehouse), and the act itself is transferred to the company’s accounting department for the final completion of the write-off procedure.

Conditions and period of document storage

After the process of writing off the property is completed, the act must be kept along with other similar documents in the archives of the enterprise in case of a possible tax audit. The duration of storage is determined by the internal regulations of the enterprise or the legislation of the Russian Federation. After the act loses its relevance, it can be disposed of.

How to properly organize accounting and write-off in such cases? These questions come before the accountant of every organization, since not a single enterprise can do without the use of this type of materials in production. Let's take a closer look at how to properly organize accounting for the movement of these things in production. Article navigation

- 1 What is MBP

- 2 Main features of IBP for inclusion in the write-off act

- 3 How to draw up an act

- 4 What are the accounting entries with IBP

- 5 What should be included in the act

- 6 How to issue an order for a commission to write off an IBP

- 7 Inventory of IBP

What is MBP? In almost every type of activity and in industry, there is inventory that does not belong to the main means of production, but is a mandatory accompanying type of materials.

Features of accounting for low-value and wearable items

Attention

At the same time, in production they often resorted to a price limit, without taking into account the service period. In this way, IBEs were formed into an independent group, which was dealt with by entire departments of institutes, conducting various studies on them.

How to draw up an act To draw up an act, a special type of entering information is provided. The form was developed according to the MB-8 form, approved at the legislative level of the Russian Federation.

The document code is indicated in the OKUD classifier with the value 0320004. But, despite the same requirements for the execution of this act, organizations can edit it and make their own changes for ease of filling out.

Info

Before you begin to draw up documentation for the write-off of an IBP, a decision must be made about this by the management of the organization. It can also be accepted by representatives of the commission, which includes experts.

The order to appoint competent members of the commission is issued by the head of the organization.

Low-value and wear-and-tear items (MBP)

In particular, it is required to indicate:

- name of the object being written off;

- its nomenclature and inventory numbers;

- unit of measurement;

- cost and number of objects being written off (if they are of the same type);

- passport number of the item being written off;

- the date when operation of the facility began;

- date and reason for write-off.

After the act is completed and executed, both the chairman of the commission and all its members put their signatures at the end of the document, indicating their initials and positions. The procedure for drawing up the act is completed by the storekeeper, who marks the date of acceptance of the written-off low-value property into the warehouse.

The composition of the information reflected in the act developed independently should be similar. You can download a completed sample based on the MB-8 form on our website.

Mbp - what is it? accounting for low-value and wearable items

Important

The second option was, of course, used more often. It was simpler for an accountant. Moreover, the first one had its drawbacks. In the month of purchase, the entire cost of the object was included in the balance sheet, and this illogically increased the profit of that month.

Further, of course, the uniform charge of depreciation reduced the profit of subsequent reporting periods, but this was not entirely correct. From a scientific point of view, both options were imperfect.

There was another drawback in accounting for IBP. There are some things whose price is low. Practicing accountants insisted that these items were immediately written off as operating expenses.

And there is no need for any depreciation or wear. Quite convenient, isn't it? But theorists were very confused by this approach. However, their opinion did not have much influence on the outcome of the case. Practice remains practice, because all this reduced the profit of the enterprise in the month of purchase, and therefore simplified the work of accountants.

Act on write-off of low-value and wear-and-tear items

In the month when the MBP was purchased, its full cost was reflected in the entries and unjustified profits immediately increased. And although in the future the amount gradually decreased due to wear and tear and, accordingly, contributed to a decrease in profits in the future, this was still not entirely correct.

Both methods of writing off IBP are considered imperfect from a scientific point of view. There is another significant drawback in accounting for IBP, which concerns things with very low prices.

Write-off of IBP according to Shchuko To facilitate the accounting of products, accountants ensured that low-value funds were immediately written off as current expenses in the month of their receipt. In this case, there is no need to calculate the percentage of depreciation or amortization, which is a convenient point for accounting. Theorists were outraged by this write-off procedure, but this did not affect the outcome of the case.

Disposal of low-value and high-wear items

It should be taken into account that we consider as IBP part of the organization’s inventories, the service life of which is less than one year, while their cost does not play a role (they are wearable). Another principle for classifying goods into this group is the upper limit on the cost of low-value wearable items.

It is this that determines whether to classify them as fixed assets or specifically as IBP. Thus, the cost of the MBP is a significant criterion. Using a similar definition, low-value wearable items include work clothes, shoes, office equipment, dishes, household items, etc. Regardless of their useful life and cost, the MBP group also includes specialized tools, devices for specific purposes necessary for production; replacement equipment parts; fishing gear; chainsaws.

Features of accounting and taxation of low-value and wearable items

During the work, members of the commission examine quickly worn-out equipment and study the technical documentation attached to it. Thus, the degree of wear and suitability of the inspected tools and other materials associated with the production process is established.

When writing off certain items, the commission is based not only on examination data. All characteristics set out in the technical documentation are taken into account.

When filling out the columns of the form for writing off IBP, their initial cost is first displayed. It is taken from the costs that were actually spent on their acquisition or production. If it is decided that such items can be sold, then this can happen either at the same cost or at a price different from the original price of the product.

It must be taken into account that when they are sold for an amount exceeding their cost, the difference must be included in the organization’s income. In other cases, an act is drawn up for the write-off of low-value and wear-and-tear items, the form of which is filled out separately by type of similar items in a single copy.

The completed form is transferred to the warehouse together with the MBP to be disposed of. Storekeepers are required to sign the form to confirm that materials have been written off.

From the warehouse, the document goes to the accounting department as a fundamental act for removing unsuitable materials and tools from accounting.

To enter information on the depreciation of low-value items with a short useful life, use account 13 “Depreciation of IBP”. According to its credit, in correspondence with the production cost accounts, the amount of depreciation of the IBP is shown, and the debit of account 13 from credit 12 reflects the purchase cost of inventory that has been retired.

They formalize the transfer of the IBP into operation for long-term use using an invoice. In case of their breakdown, damage, loss of tools and devices, the head of the department must draw up a decommissioning act for the IBP.

An exception in these cases concerns circumstances in which the worker’s guilt in the unsuitability of the IBP is established, since the cost of a damaged or lost item must be deducted from his salary. What should be included in the act There are no particular difficulties in documenting the write-off of the IBP.

Write-off of low-value and wear-and-tear items in a budget organization

Download sample form No. MB-8 IMPORTANT! If it is simultaneously decided to write off several items at once, the MB-8 act must be issued separately for each such item, if they belong to different types. A general act can be for several items of the same type.

Results An act for writing off low-value and wear-and-tear items is drawn up in cases where the company decided to write off items that were no longer suitable for use, necessary for the implementation of the work process, but due to their insignificant value were not accepted as part of the operating system. Such an act is drawn up either according to the standard form MB-8, or according to its own template, which also contains all the necessary information about the object being retired from use.

VAT);

- Debit account 20, 23 / Credit account. 02 (accrual of depreciation);

- Debit account 02 / Credit account 01 (write-off of an item not earlier than its complete wear and tear).

The price of the IBP is written off to accounts 20, 25, 26, 44 depending on the place of its use (auxiliary or main production) using the following transactions:

- Debit account 10/9 / Credit account 60 (acceptance of IBP into account).

- Debit account 20 (25, 26, 44) / Credit account. 10/9 (writing off an item after it is completely worn out).

For your information! Immediately after capitalization, it is allowed to write off in full objects with a service life of up to 12 months, or in parts, objects for which use is planned for 2 years. Despite the possibility of complete or partial write-off, the assessment of IBP in accounting is reflected until it is completely worn out.

Read more about the criteria for classification as fixed assets in the article “Guidelines for accounting of fixed assets.” Despite the fact that such objects are not considered fixed assets, they have a certain service life, after which the company can no longer operate them. In such a situation, it becomes necessary to write off these property items. For these purposes, a special act is drawn up. NOTE! Currently, there is no single form of the act in question that is mandatory for all companies.

At the same time, until 2013, this was the MB-8 template, approved by Decree of the State Statistics Committee of the Russian Federation dated October 30, 1997 No. 71a. Therefore, when writing off low-value property in 2017, a company can use the standard form of the MB-8 act or draw up a write-off act developed independently.

Disposal as a result of damage or loss.

The expiration of the standard service life in itself is not the reason for the removal of the MBP from service. The MBP is taken out of service and deregistered if its further use for its intended purpose is impossible, for example due to complete wear and tear or malfunction. However, wear and tear or breakdown may occur before the end of the item's standard service life. This means that by the time the small business enterprise is written off from the register, its cost may not be fully repaid using certain depreciation methods.

Let's consider the operations for writing off MBP from the register under various options for decommissioning at the Velmash plant. Such transactions are reflected in accounting as follows:

Debit account 10, Credit account 12-2 - the cost of material assets received as a result of disposal of small business enterprises.

Debit account 20, Credit account 13 - additional depreciation was added in the amount of the remaining 50% of the cost of the IBP minus the cost of the material assets received.

Debit account 13, Credit account 12-2 - debiting the IBP from accounting.

Registration of breakdown and loss of MBP is carried out using the MB-4 form “Act of disposal of MBP”. On the basis of this act, an “Act for decommissioning of small-scale enterprises” is drawn up in the MB-8 form (drawn up in 1 copy). If the disposal of the IBP occurred due to the fault of the employee, then the amount of damage and the procedure for compensation are determined in accordance with current legislation.

Implementation.

Operations for the sale of IBP are subject to reflection in account 48 “Sale of other assets”. The debit of account 48 reflects the book value of the disposed items, as well as the expenses incurred in connection with this; the credit of account 48 includes the proceeds from the sale of valuables, as well as the amount of depreciation accrued on these objects at the time of disposal. When implementing the IBP, the following transactions will be made:

Debit account 48, Credit account 12 - write-off of the accounting value of the small business enterprise.

Debit account 13, Credit account 48 - write off accrued depreciation.

Debit of account 62, Credit of account 48 - reflection of revenue from the sale of IBP (under the agreement).

Debit account 48, Credit account 68 - VAT is charged on the cost of sales.

Debit of account 48, Credit of account 80 - the financial result from the sale of IBP (profit) is revealed

Debit of account 80, Credit of account 48 - financial result - loss.

If an organization exchanges IBP, then for tax purposes the actual market price for similar property prevailing at the time of fulfillment of obligations under the transaction is accepted.

When transferring IBE as a contribution to the authorized capital, the correspondence of accounts will look like this:

Debit account 48, Credit account 12 - the accounting value of the small business enterprise is written off.

Debit account 13, Credit account 48 - accrued depreciation is written off.

Debit account 06, Credit account 48 - transferred to IBP as a contribution to the authorized capital at an agreed upon cost.

Debit account 80 (48), Credit account 48 (80) - the financial result from the disposal of the small business enterprise is identified - loss (profit).

Gratuitous transfer is also carried out using account 48, and the correspondence of accounts is the same as during the sale, but there is a posting: debit of account 62, credit of account 48; and the resulting loss (debit to account 80, credit to account 48) does not reduce taxable profit. It should be assumed that the party receiving IBP free of charge does not enter account 19 “input VAT”, but takes it into account in the total cost of received items.

3.5. Inventory of IBP. Reflection of results in accounting.

Organizations are required to conduct an inventory of small business enterprises in the manner and within the time limits established by the Regulations on Accounting and Reporting in the Russian Federation (but at least once a year).

In accordance with the Methodological Guidelines for the Inventory of Property and Financial Liabilities, approved by orders of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49, SBPs in operation are inventoried at their locations and the MOL in which they are stored.

Inventory is carried out by examining each item. IBPs are entered into inventory records by name in accordance with the nomenclature adopted in the accounting of the enterprise.

When making an inventory of small items issued for individual use to employees, it is allowed to draw up group inventory lists indicating in them the persons responsible for these items, for whom personal cards have been opened, with a receipt for them in the inventory.

Items of workwear and table linen sent for washing and repair are recorded in the inventory list on the basis of delivery notes or receipts from organizations providing these services.

IBPs that have become unusable, but not written off, are not included in the inventory list, and an act for decommissioning of IBPs is drawn up for them (Appendix 8).

If, as a result of the inventory carried out at the enterprise, a shortage of IBP is revealed due to the fault of the MOL, then the fact of the shortage of property is reflected in accounting using account 84 “Shortages and losses from damage to valuables” using the following entries:

Debit account 84, Credit account 12 - shortage in the amount of the actual cost of the IBP minus depreciation. The difference between the actual and market value of lost valuables is reflected in accounting using account 73 (sub-account “Calculations for compensation of material damage”) and account 83 “Deferred income”:

Debit account 73, Credit account 84 - assigning the amount of the shortfall to the guilty party.

Debit account 73, Credit account 83 - a reflection of the difference between the actual and market value of the small business enterprise.

After repaying the MOL debt (Debit account 50, Credit account 73 - for the amount of debit turnover on account 73), the difference in the excess of the market price over the actual cost of the IBP is attributed to the results:

Account debit 83, account credit 80.

4. Analysis of accounting for the availability and use of IBP.

4.1. Methodological basis for the analysis of IBP.

IBP analysis is carried out in the following directions:

Study and analysis of the structure of IBP, their condition and dynamics;

Analysis of the organization's provision with low-value and wearable items;

Analysis of general indicators of the use of IBP and factors influencing them.

The sources of information when analyzing IBP are, first of all, all primary documents for recording the receipt, movement and disposal of IBP (including unified forms of primary accounting documentation for IBP accounting: MB-2 “IBP Accounting Card”, MB-4 “IBP Disposal Certificate”, MB-7 “Record of issue of special clothing, safety footwear and safety equipment”, MB-8 “Act for decommissioning of IBP”). The forms are primary documents that record business transactions regarding the receipt, movement, and disposal of small business enterprises, and at the same time perform the functions of an analytical accounting register. They are used by various services and departments of the organization for operational, managerial, statistical and accounting.

An important and necessary source of information when analyzing the IBP is the balance sheet (Form No. 1): Section II “Current assets”, line 213 “Low-value and wear-and-tear items”, where the value of the IBP is given taking into account accrued depreciation (that is, at the residual value). When analyzing the IBP, the Appendix to the balance sheet (Form No. 5) is also used: Section III “Depreciable property”, lines 380 .382: “IBP - total”, including “In stock”, “In operation”; Certificate for section III, which shows the wear and tear of the MBP (line 396); as well as Section VI “Costs incurred by the organization”, which presents costs by element.

In the month when the MBP was purchased, its full cost was reflected in the entries and unjustified profits immediately increased. And although in the future the amount gradually decreased due to wear and tear and, accordingly, contributed to a decrease in profits in the future, this was still not entirely correct. Both methods of writing off IBP are considered imperfect from a scientific point of view. There is another significant drawback in accounting for IBP, which concerns things with very low prices. Write-off of IBP according to Shchuko To facilitate the accounting of products, accountants ensured that low-value funds were immediately written off as current expenses in the month of their receipt. In this case, there is no need to calculate the percentage of depreciation or amortization, which is a convenient point for accounting. Theorists were outraged by this write-off procedure, but this did not affect the outcome of the case.

Form MB-8. act on write-off of low-value and wear-and-tear items

During the work, members of the commission examine quickly worn-out equipment and study the technical documentation attached to it. Thus, the degree of wear and suitability of the inspected tools and other materials associated with the production process is established.

When writing off certain items, the commission is based not only on examination data. All characteristics set out in the technical documentation are taken into account.

When filling out the columns of the form for writing off IBP, their initial cost is first displayed. It is taken from the costs that were actually spent on their acquisition or production.

If it is decided that such items can be sold, then this can happen either at the same cost or at a price different from the original price of the product.

Act on write-off of low-value and wear-and-tear items

For this purpose, the commission or the head of the unit draws up a normative act in the MB-8 form. The document should reflect the following parameters:

- positions and individual details of commission members

- name of the IBP

- the retiring quantity in units of measurement that is used to account for these materials or products

- reason for write-off

After filling out the information about the recycled IBP, the commission members sign the act. It must also contain the signatures of the accountant for accounting of inventory items and the financially responsible person. After signing by all these persons, the document is endorsed by the chief accountant and the manager.

How to issue an order on a commission for writing off small business enterprises In order to regulate issues of writing off small business enterprises at an enterprise, a permanent commission is appointed by order of the head.

Deciphering the IBP in accounting

What are the accounting entries for the IBP? In the process of creating accounting for the IBE, several methods have been developed for reflecting them in the entries:

- Upon receipt, they were received and transferred for use with the cost entered into account 12 “Low-value wearable items.” At the end of each month during the year, 1/12 of the purchase price was written off.

Although the period of use could exceed a calendar year, the cost of the MBP was subject to complete write-off within 12 months. - When an item was handed over to the facility’s workflow, the amount was immediately reduced by 50% due to wear and tear. The remaining half was not touched until the final moment of its decommissioning.

Since the second write-off method was much simpler for an accountant, it was preferred by organizations. When writing off using the first method, its shortcomings were identified.

Blanker.ru

Instructions 1 Never be nervous or fuss if you want to write down the answer to a question posed on an independent test or test. The slightest aversion of the eyes to the side, a raised head, or an extra gesture attracts the teacher’s attention.

Attention

Think through everything to the smallest detail. 2 It is better to prepare several sets of cheat sheets for the exam. Scanned, reduced and printed copies of the lectures of the teacher who takes this exam are now very popular among students.

A very profitable option. Illustrations, symbols, and terms will not give you away if you can use them correctly. 3 Hide your cheat sheets only where you can actually get them without problems at a convenient moment. This could be a sleeve, a pencil case, a pen, or shoes.

Disposal of low-value and high-wear items

Kt - 213 b) in excess of or in the absence of the estimated residual value of the MBP: Dt - 211 Kt - 612 3. The difference between the estimated residual value of the written-off MBP and the net sales value of the materials received is reflected. The posting is made if the net sales value of the materials received is lower than the estimated residual value of the written-off MBP: Dt - 714 Kt - 213 Also, low-value and wearable items can be disposed of due to various reasons, the main of which are: - sale to other enterprises and individuals; — transfer to the authorized capital of other enterprises and as loans; — reduction (adjustment) of the cost of IBP received in previous years; - free transfer; — transfer to fixed assets; — write-off when shortages, theft or damage are identified, including due to accidents, fires, natural disasters and other reasons.

Reason codes for writing off MBP

If one of the commission members is absent at the time of decommissioning, a temporary order is issued to appoint another commission member in his place for the duration of his illness or other reason for not going to work. Inventory of IBP As a rule, an inventory of IBP is carried out at the end of the year.

Info

This procedure is carried out before drawing up the annual report. But if during the production process there is a replacement in the position of a person whose duties include financial responsibility, then an additional inventory of available material assets is carried out.

The process itself during the inventory is carried out by a separate group of people enrolled in the working commission by order of the manager. They start by checking the presence and condition of inventory cards and other technical documentation on the MBP. While studying the documentation, a parallel inspection, checking the availability and safety of inventory is carried out.

Reason codes for writing off low value items

If the product is suitable for further use, then it is included in the inventory of actual availability. The list of items during the inventory is compiled according to the following characteristics:

- product name

- assigned inventory number

- technical specifications

- purchase price, etc.

Products and materials that have become unusable are not included in the inventory register. They are included in a separate list indicating the time of commissioning, the reasons that caused their loss of functionality, and other indicators. Then, according to this list, write-off acts are drawn up. Note! Inventory records are compiled separately for fixed assets and small business enterprises. Moreover, the latter are recorded in separate lists according to the place of their storage and use, as well as by financially responsible persons.

It must be taken into account that when they are sold for an amount exceeding their cost, the difference must be included in the organization’s income. In other cases, an act is drawn up for the write-off of low-value and wear-and-tear items, the form of which is filled out separately by type of similar items in a single copy. The completed form is transferred to the warehouse together with the MBP to be disposed of. Storekeepers are required to sign the form to confirm that materials have been written off. From the warehouse, the document goes to the accounting department as a fundamental act for removing unsuitable materials and tools from accounting.

Reason code for writing off low value

At the same time, in production they often resorted to a price limit, without taking into account the service period. In this way, IBEs were formed into an independent group, which was dealt with by entire departments of institutes, conducting various studies on them. How to draw up an act To draw up an act, a special type of entering information is provided. The form was developed according to the MB-8 form, approved at the legislative level of the Russian Federation. The document code is indicated in the OKUD classifier with the value 0320004. But, despite the same requirements for the execution of this act, organizations can edit it and make their own changes for ease of filling out. Before you begin to draw up documentation for the write-off of an IBP, a decision must be made about this by the management of the organization. It can also be accepted by representatives of the commission, which includes experts. The order to appoint competent members of the commission is issued by the head of the organization.

The items listed in this act, in the presence of the commission, were turned into scrap, which is subject to capitalization according to the invoice: soft equipment - rags, hard equipment and others - scrap metal and boards. Scrap that is not subject to accounting is destroyed. This act is certified by the chairman of the commission and all members of the commission. Also, the enterprise can draw up a “Certificate of Disposal of Low-Value and Wearable Items”, which is used to document the breakdown and loss of tools (devices) and other low-value and wearable items. Drawed up in one copy by the foreman and the initial workshop (section) for one or more workers. In case of breakdown, damage or loss of the IBP due to the fault of the employee, the report is drawn up in two copies.

Low value items - disposable tableware

A well-drafted act for writing off low-value and wear-and-tear items will allow the company to include them in expenses when calculating.

How to properly organize accounting and write-off in such cases?

These questions come before the accountant of every organization, since not a single enterprise can do without the use of this type of materials in production.

Let's take a closer look at how to properly organize accounting for the movement of these things in production.

Article navigation

What is IBP

In almost every type of activity and in industry, there is inventory that does not belong to the main means of production, but is a mandatory accompanying type of materials. Such equipment is characterized by low use in the labor process due to the fact that it quickly loses its suitability.

In accounting, they were given the term “low-value wearable items,” abbreviated as LBP. Their cost, despite the short period of use, is included in the company’s reserves.

Note! It is the shelf life of inventory that is the main criterion for inclusion in the IBP list. Their number accounts for the entire part of the organization’s materials, the period of use of which is less than 1 year.

Based on these boundaries in relation to the characteristics of materials and things, the following goods can be classified as IBP:

- work clothes and footwear for workers

- quickly wearing parts of office equipment

- catering utensils

- household utensils, detergents and cleaning products, etc.

Such inventory and materials, regardless of the period of suitability and cost, can include various additional devices for narrow purposes, special tools, without which it is impossible to carry out production tasks. Among the names of such items are the following:

- replacement spare parts for machine tools and other equipment

- fishing equipment

- chainsaws

However, this should not include construction tools; mechanisms, equipment used in agriculture; animals used in farming. They are classified as fixed assets, while their services and costs do not affect their inclusion in the IBE group.

The main features of the IBP for inclusion in the write-off act

Due to the short service life of SBPs, they must be written off when preparing financial statements.

For this purpose, a special form MB-8 is used, an act for writing off low-value and wear-and-tear items.

How can we determine that an item belongs to the IBP and can be included in this document?

How to correctly apply the rationale for things and materials so that they truly are IBP.

From the name of such materials it can be understood that the criteria for including such production equipment in this group are low price and rapid wear.

The time limit for suitability for classifying things as IBP changed periodically. Only the service life remained constant for one year.

Based on these justifications, it can theoretically be assumed that there are 4 main ones for evaluating purchased items for the group we are considering:

- The price of the item is below the monetary limit, but its useful life may be more than one year.

- The cost of the inventory is more than the limit, but it is suitable for use for up to 1 year.

- The material does not exceed the cost of purchasing it from the established upper limit, but will last more than 12 months.

- The item lasts less than 1 year and costs less than the price limit.

Quite recently, only by the fourth characteristic of an object could it be included in the IBP. As for the first, second and third, previously these were fixed assets. At the same time, in production they often resorted to a price limit, without taking into account the service period.

In this way, IBEs were formed into an independent group, which was dealt with by entire departments of institutes, conducting various studies on them.

How to draw up an act

To draw up an act, a special type of information is provided. The form was developed according to the MB-8 form, approved at the legislative level of the Russian Federation. The document code is indicated in the OKUD classifier with the value 0320004. But, despite the same requirements for the execution of this act, organizations can edit it and make their own changes for ease of filling out.

Before you begin to draw up documentation for the write-off of an IBP, a decision must be made about this by the management of the organization. It can also be accepted by representatives of the commission, which includes experts.

The order to appoint competent members of the commission is issued by the head of the organization.

During the work, members of the commission examine quickly worn-out equipment and study the technical documentation attached to it. Thus, the degree of wear and suitability of the inspected tools and other materials associated with the production process is established.

When writing off certain items, the commission is based not only on examination data. All characteristics set out in the technical documentation are taken into account.

When filling out the columns of the form for writing off IBP, their initial cost is first displayed. It is taken from the costs that were actually spent on their acquisition or production.

If it is decided that such items can be sold, then this can happen either at the same cost or at a price different from the original price of the product. It must be taken into account that when they are sold for an amount exceeding their cost, the difference must be included in the organization’s income.

In other cases, an act is drawn up for the write-off of low-value and wear-and-tear items, the form of which is filled out separately by type of similar items in a single copy. The completed form is transferred to the warehouse together with the MBP to be disposed of.

Storekeepers are required to sign the form to confirm that materials have been written off. From the warehouse, the document goes to the accounting department as a fundamental act for removing unsuitable materials and tools from accounting.

What are the accounting entries for IBP?

To facilitate accounting for products, accountants ensured that low-value funds were immediately written off as operating expenses in the month they were received.

In this case, there is no need to calculate the percentage of depreciation or amortization, which is a convenient point for accounting.

Theorists were outraged by this write-off procedure, but this did not affect the outcome of the case.

Practice has shown the advantages of this method of writing off IBP, since it immediately reduced the revenue side in the month of purchase and made it easier to account for them.

Since the amount of depreciation is included in production costs, it must be taken into account when determining the tax contribution.

As we have already described, very often in practice accounting is carried out in the two most convenient ways:

- calculation of depreciation in the amount of 50% of the original cost when issuing them from the warehouse for operation, and the second half after receiving the decommissioning certificate for the IBP

- reflect 100% wear and tear when issuing MBP to workers to perform production tasks

There are no strict restrictions on this matter, therefore the enterprise has the right to independently choose the most convenient method of calculating depreciation of the IBP and apply it throughout the entire calendar year.

To enter information on the depreciation of low-value items with a short useful life, use account 13 “Depreciation of IBP”. According to its credit, in correspondence with the production cost accounts, the amount of depreciation of the IBP is shown, and the debit of account 13 from credit 12 reflects the purchase cost of inventory that has been retired.

They formalize the transfer of the IBP into operation for long-term use using an invoice.

In case of their breakdown, damage, loss of tools and devices of the unit, an act of decommissioning of the IBP must be drawn up. An exception in these cases concerns circumstances in which the worker’s guilt in the unsuitability of the IBP is established, since the cost of a damaged or lost item must be deducted from his salary.

What should be included in the act

There are no particular difficulties in documenting the write-off of IBP. For this purpose, the commission or the head of the unit draws up a normative act in the MB-8 form.

The document should reflect the following parameters:

- positions and individual details of commission members

- name of the IBP

- the retiring quantity in units of measurement that is used to account for these materials or products

- reason for write-off

After filling out the information about the recycled IBP, the commission members sign the act. It must also contain the signatures of the accountant for accounting of inventory items and the financially responsible person. After signing, all these persons are endorsed by the chief accountant and the manager.

How to issue an order on a commission for writing off an IBP

In order to regulate issues related to the write-off of IBP at the enterprise, a permanent commission is appointed by order of the manager. Who needs to be appointed in such cases and what are the nuances of its design?

The commission must include any persons from the administration of the enterprise who are competent in matters of wear and tear and accounting of small-scale equipment. These can be persons from the engineering and technical staff of the enterprise, accounting department, quality control department, laboratory, if there is one in production. The main thing is that people can competently assess and justify the deterioration of the MBP.

The order indicates the positions and individual details of each member of the commission. Then they enter the reason for issuing the decree: “For the purpose of organizing the establishment of storage periods for documents, their selection for archival storage and use, I order: Create an expert commission.” Next comes a list of the members of the commission, starting with the chairman.

The issue is not regulated by legislative acts. If one of the commission members is absent at the time of decommissioning, a temporary order is issued to appoint another commission member in his place for the duration of his illness or other reason for not going to work.

IBP inventory

As a rule, at the end of the year an inventory of IBP is carried out. This procedure is carried out before drawing up the annual report. But if during the production process there is a replacement in the position of a person whose duties include financial responsibility, then an additional inventory of available material assets is carried out.

The process itself during the inventory is carried out by a separate group of people enrolled in the working commission by order of the manager. They start by checking the presence and condition of inventory cards and other technical documentation on the MBP.

While studying the documentation, a parallel inspection, checking the availability and safety of inventory is carried out. If the product is suitable for further use, then it is included in the inventory of actual availability.

The list of items during the inventory is compiled according to the following characteristics:

- product name

- assigned inventory number

- technical specifications

- purchase price, etc.

Products and materials that have become unusable are not included in the inventory register. They are included in a separate list indicating the time of commissioning, the reasons that caused their loss of functionality, and other indicators. Then, according to this list, write-off acts are drawn up.

Note! Inventory records are compiled separately for fixed assets and small business enterprises. Moreover, the latter are recorded in separate lists according to the place of their storage and use, as well as by financial persons.

After the transfer of the IBP registers compiled during the inventory, a reconciliation of their actual availability and those recorded in the accounting department is carried out. If, in the process of reviewing the compliance of the inventory with accounting data, discrepancies are identified, then the first step is to establish the reasons for their occurrence.

Further accounting will depend on whether it is necessary to write off worn-out equipment or withhold their value from the person responsible for the disappearance or breakdown.

In tax accounting, the write-off of small business enterprises is recognized as a production cost, which allows reducing the payment of the contribution to the Federal Tax Service only if the accounting and documentation are correct. Use our recommendations to draw up an act of write-off of small business enterprises and this will help you reliably confirm expenses.

How to capitalize an IBP is shown in the video:

Submit your question in the form below